How to Identify Undervalued Stocks in the Market

Investing in undervalued stocks can be a powerful strategy for long-term growth. The premise behind this approach is simple: buy stocks that are trading for less than their intrinsic value, then hold onto them as the market corrects and prices rise. However, identifying undervalued stocks requires more than just looking for low prices; it involves thorough research and analysis. Let’s explore how to identify undervalued stocks. We’ll be using key financial metrics and strategies.

What Does It Mean for a Stock to Be Undervalued?

A stock is considered undervalued when its current market price is below its intrinsic value—the actual worth of the company based on its fundamentals, such as earnings, assets, and growth potential. This discrepancy often occurs due to market inefficiencies, temporary setbacks, or investor sentiment.

Investors who successfully identify and buy undervalued stocks can earn significant profits when the market recognizes the stock’s value and prices adjust upward.

Key Metrics to Identify Undervalued Stocks

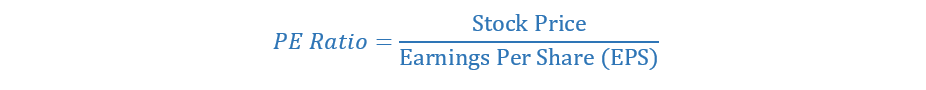

1. Price-to-Earnings (P/E) Ratio

The P/E ratio is one of the most widely used valuation metrics. It compares a company’s stock price to earnings per share (EPS).

- Low P/E Ratio: A lower-than-average P/E ratio may indicate that a stock is undervalued, especially when compared against its peers in the industry or historical P/E levels.

- High P/E Ratio: A high P/E ratio suggests that a stock may be overvalued or that investors expect significant future growth.

Example: If a company’s stock trades at $50 per share and its EPS is $5, the P/E ratio would be 10. The stock may be undervalued if the average PE ratio of the industry is 20.

2. Price-to-Book (P/B) Ratio

The P/B ratio compares a company’s stock price to its book value (value of its assets minus liabilities). This ratio helps investors evaluate whether a stock trades for more or less than its actual net worth.

- Low P/B Ratio: A P/B ratio below one(1) may indicate that a stock is undervalued, as it trades below its book value.

- High P/B Ratio: A higher P/B ratio suggests that investors are willing to pay more than the company’s book value, which may indicate overvaluation.

Example: If a company’s stock price is $30 and its book value per share is $40, the P/B ratio is 0.75, which could suggest the stock is undervalued.

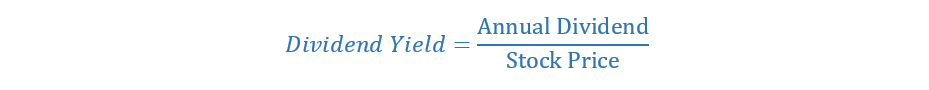

3. Dividend Yield

The dividend yield is the annual dividend payment divided by the stock price. It’s a helpful metric for income-focused investors who want to identify undervalued dividend-paying stocks.

- High Dividend Yield: A higher-than-average dividend yield may signal that a stock is undervalued, as the company generates significant income for shareholders relative to its current price.

- Caution: However, an excessively high dividend yield can sometimes be a warning sign of a troubled company. So, you must evaluate the company’s fundamentals.

Example: If a stock trades at $40 and pays an annual dividend of $4, its dividend yield is 10%. If the average yield in the sector is 5%, this could indicate that the stock is undervalued.

4. Price-to-Earnings-to-Growth (PEG) Ratio

The PEG ratio adjusts the P/E ratio by factoring in the company’s earnings growth rate, providing a more comprehensive picture of a stock’s valuation.

- PEG < 1: A PEG ratio below 1 suggests the stock may be undervalued relative to its growth potential.

- PEG > 1: A PEG ratio above 1 implies the stock is trading at a premium relative to its growth rate.

Example: If a company has a 15 P/E ratio and an expected earnings growth rate of 20%, the PEG ratio is 0.75, indicating that the stock may be undervalued.

5. Free Cash Flow (FCF)

Free cash flow (FCF) represents the cash a company generates after accounting for capital expenditures. It’s a critical metric because it shows whether a company has enough money to return value to shareholders, pay down debt, or reinvest in growth.

- Positive FCF: Companies with strong, positive free cash flow are often undervalued if their market price doesn’t reflect this financial strength.

- FCF Yield: Similar to dividend yield, FCF yield compares free cash flow to the company’s stock price, providing insight into how much cash the company generates relative to its valuation.

Example: A company generating $10 million in free cash flow with a market capitalization of $100 million has an FCF yield of 10%. The stock may be undervalued if competitors have an FCF yield of 5%.

Qualitative Factors to Consider

1. Strong Competitive Position

Look for companies that have a competitive advantage or moat in their industry. Companies with strong brand loyalty, unique products or services, and barriers to entry are often undervalued because the market may overlook their long-term potential. Examples include companies like Coca-Cola and Amazon, which have massive competitive advantages.

2. Management Quality

A company’s leadership team plays a crucial role in driving its success. Experienced and visionary management can help navigate challenging economic conditions and capitalize on growth opportunities. Look for companies with a track record of good governance and prudent financial management.

3. Market Sentiment

Sometimes, a stock becomes undervalued due to unfavorable market sentiment rather than poor fundamentals. For instance, widespread economic concerns or industry-specific downturns may push prices lower temporarily. If the company has strong fundamentals, this could be an opportunity to invest.

Screening Tools for Identifying Undervalued Stocks

Several tools can help you screen for undervalued stocks based on key financial ratios and metrics. Some popular screening platforms include:

- Yahoo Finance: Offers free stock screening tools that allow you to filter by P/E ratio, P/B ratio, dividend yield, and more.

- Morningstar: Provides in-depth stock analysis, fair value estimates, and screening options based on financial metrics.

- Finviz: A stock screener that lets you filter stocks based on some criteria, including valuation metrics like P/E, P/B, and PEG ratios.

Final Steps Before Investing in Undervalued Stocks

Once you’ve identified potential undervalued stocks, it’s necessary to perform a thorough analysis:

- Check the Company’s Financial Statements: Review the company’s balance sheet, income statement, and cash flow statement to ensure its financial health.

- Look for Consistent Earnings Growth: Companies with consistent earnings growth are more likely to be undervalued than in financial trouble.

- Consider Industry Trends: Ensure that the stock isn’t undervalued due to significant risks within the industry or sector.

- Understand the Risks: All investments carry risks, and undervalued stocks can remain undervalued for extended periods. Be patient and avoid making investment decisions based on short-term price movements.

Final Thoughts

Identifying undervalued stocks requires a combination of quantitative analysis and qualitative judgment. By focusing on vital financial metrics like the P/E ratio, P/B ratio, and free cash flow while considering factors like management quality and market sentiment, you can increase your chances of finding stocks that trade below their intrinsic value. Remember, patience and thorough research are critical to success in value investing. Investing in undervalued stocks can provide significant returns over time, but it’s essential to have a long-term perspective and avoid chasing short-term gains.